In a digital financial ecosystem:

- All representation of value is in token form at addresses on a digital ledger

- All flows of value are token flows on the digital ledger

- The location of each token defines its ownership

- Physical and organisational assets exist off-ledger, with only their title tokenised on-ledger

- Everything else exists only on-ledger, as native digital cash tokens, or as native digital asset tokens

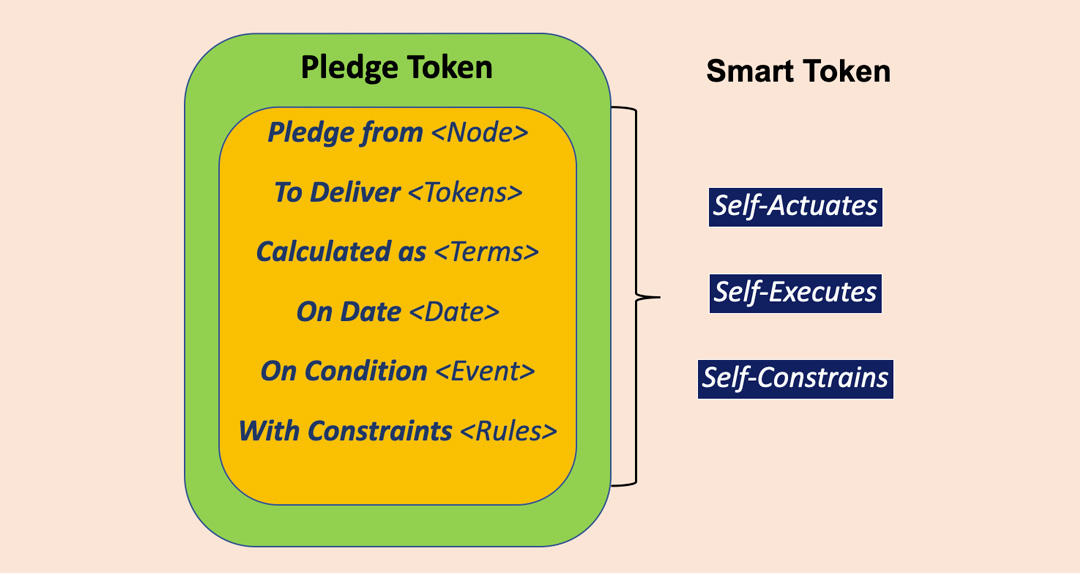

- Native digital tokens represent either inherent value in cash or assets, or commitments to future flows of value

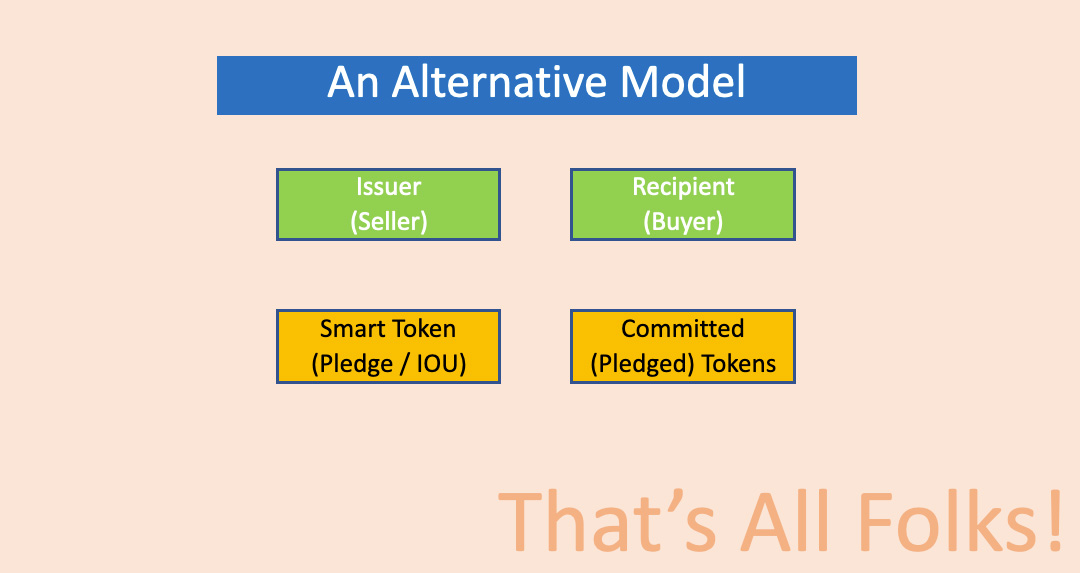

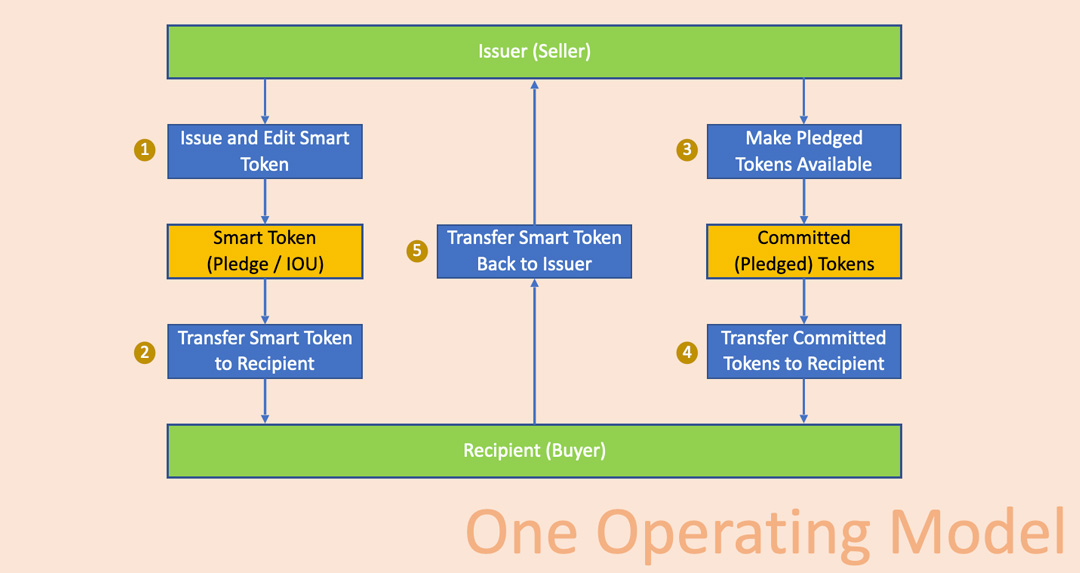

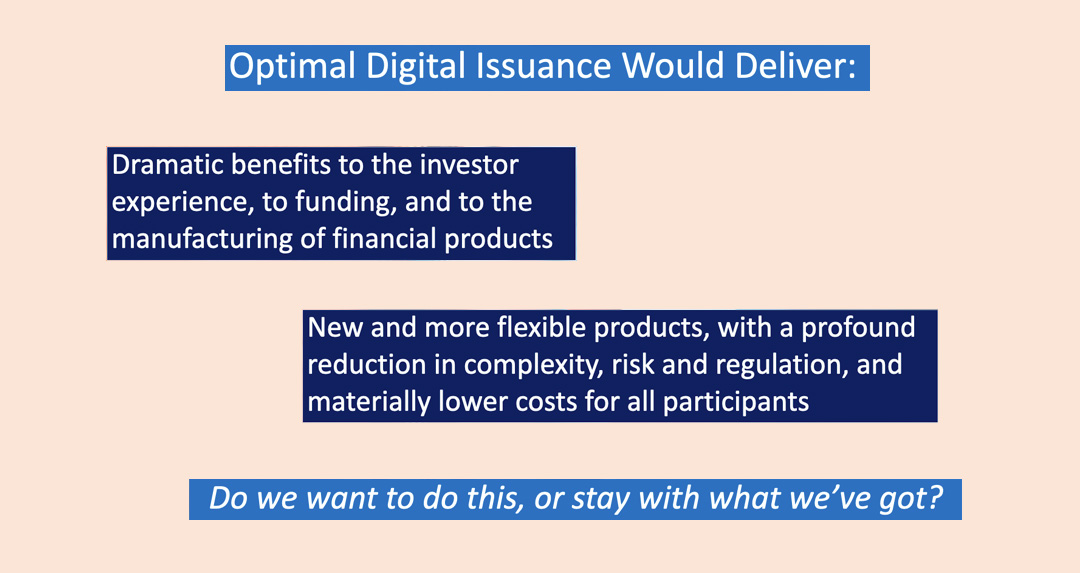

- Issue native asset tokens that represent flow commitments, not conventional assets

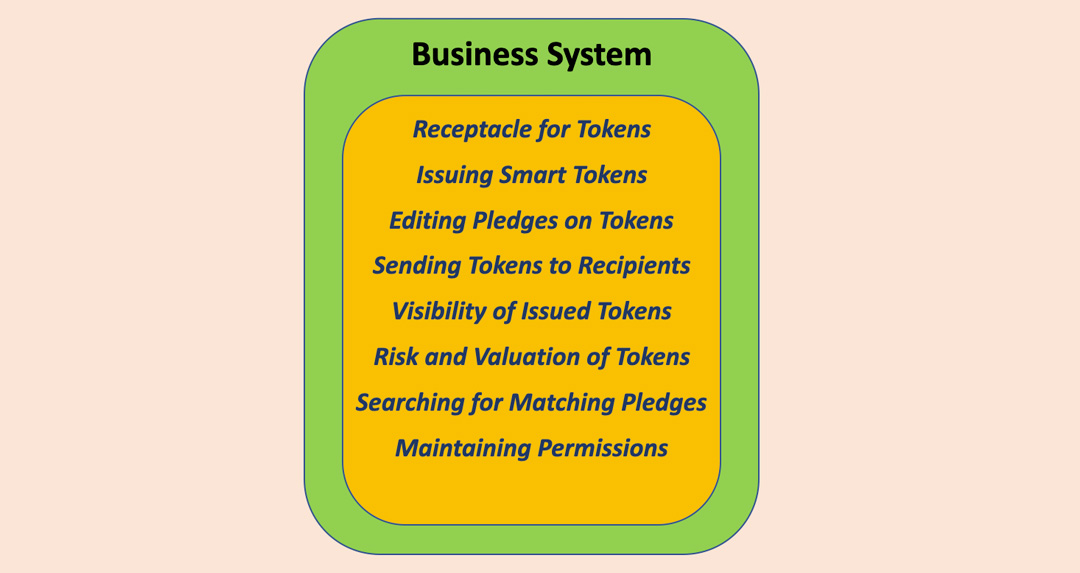

- Make the flow tokens smart and potent, rather than the business systems

- Make these smart tokens self-actuating, self-executing and self-limiting

- Make the smart tokens individually fractionalisable and tradeable

- Measure value and risk at the level of the tokens, not of the assets

- One smart token = one commitment to one flow from one issuer to one recipient

©2025 Digital Issuance

Website design by Modern Websites